The evolving job of those investors that handle the engagement

– The job of those that handle engagement within investors is evolving.

– The job requires a higher degree of expertise, approaching the level of expertise that a board member should have.

This note from Nawar Alsaadi is interesting:

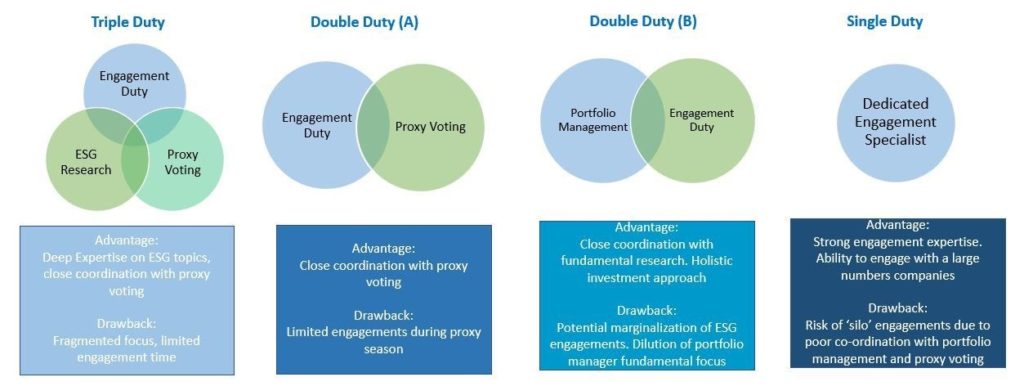

Here is a screen shot of the engagement job function within asset management firms, I have categorized engagement jobs under 4 categories, ranging from handling three duties (ESG thematic research, proxy and engagement) all the way to a dedicated engagement function.

In a discussion with Mark Van Clieaf, he alluded to the need of upgrading the engagement function by potentially introducing a new role, which I will call here ‘Strategic Engagement.’ Strategic Engagements are high level engagements focused on a total re-shuffle of a given issuer corporate strategy. Strategic engagements can only be conducted by deeply experienced professionals who have the authority and know-how to tackle large magnitude strategic shifts.

A strategic engagement department within an asset management firm should possess a depth of expertise that rivals the depth of expertise at the board of the engaged company. I believe the increased focus on stewardship and engagement requires the development of such a skill-set, something entities such as the Principles for Responsible Investment should consider as they further develop their active ownership 2.0 concept.