The latest “Network for Greening the Financial System” short-term scenarios

Here’s a note from David Carlin:

Really excited about the latest NGFS short-term scenarios! This concept note introduces new narratives and considerations for financial institutions.

The inclusion of additional short-term scenarios supports what I’ve called a “toolkit” approach to climate risk assessment. There’s no one model or scenario type (tool) that will be able to offer a comprehensive view of the diverse financial risks of climate change and the transition. As a result we need to explore both long and short term scenarios, shock scenarios, tail risk scenarios, and many other kinds to do our diligence on this important issue.

And now for the scenarios themselves! Five new scenarios focusing on a time horizon of 3-5 years.

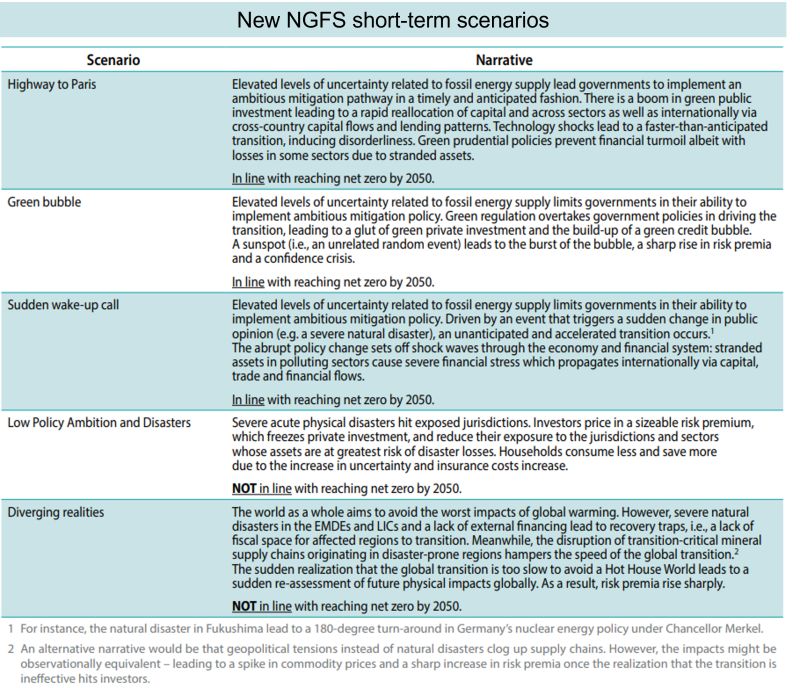

-Highway to Paris scenario: immediate and technology driven transition

-Green bubble scenario: glut of green private investment and expenditure driven by generous incentives/subsidies

-Sudden wake-up call scenario: abrupt and unanticipated transition

-Diverging realities scenario: severe divergences across countries in their net zero transition paths

-Low policy ambition and disasters scenario: low policy ambition and physical disasters

Datasets for these scenarios will be released next. Congrats to the NGFS team for this terrific work!