The false hope of ESG engagements

Here’s a note from Nawar Alsaadi:

Back when I was working as a Senior Portfolio Manager – ESG Investing at Canada Post Pension Plan. I proposed voting against members of Air Canada’s board and executive management team due to the company failure to deliver on its emissions’ commitments. I also penned a letter to explaining the rationale for the vote to the company management. However, neither the negative vote took place, or the letter was sent for the inane reason that an Air Canada board member was also serving as GP in a private equity firm where Canada Post was a limited partner.

The above encapsulates the realities of net zero engagements, and the complexity of running a genuine climate engagement program with high emitting companies amid competing business and political priorities within large institutions. This in large part explains why CA100+ has failed to deliver any real progress on the most important climate indicator of all: capital alignment.

External observers often believe that the challenge with engagement is centered around tools, resources and process. Yes, those are major obstacles, but the real challenge to meaningful engagements is a lack of institutional conviction. Unless engagers have their priorities straight, and truly mean business when pressuring companies for change, nothing is going to happen and ESG engagements will always be relegated to the domain of well-intentioned social conversations.

Over the last few years, I have read through a minimum of 300 engagement reports, and I would say the vast majority of them are nothing more than glossy marketing brochures designed to elicit a feeling of goodwill for the sake of raising AUM. The actual number of asset managers who use engagement as a genuine tool to manage risk and drive sustainability impacts is no more than a handful.

Shareholders have an incredible opportunity to effectively manage risk and drive real change by exercising their legitimate right to hold companies responsible for the negative externalities associated with their operations. But, at this stage, I would qualify ESG engagements as the mere exchange of exhaled CO2 between excessively paid C-suite executives and underpaid ESG engagement analysts.

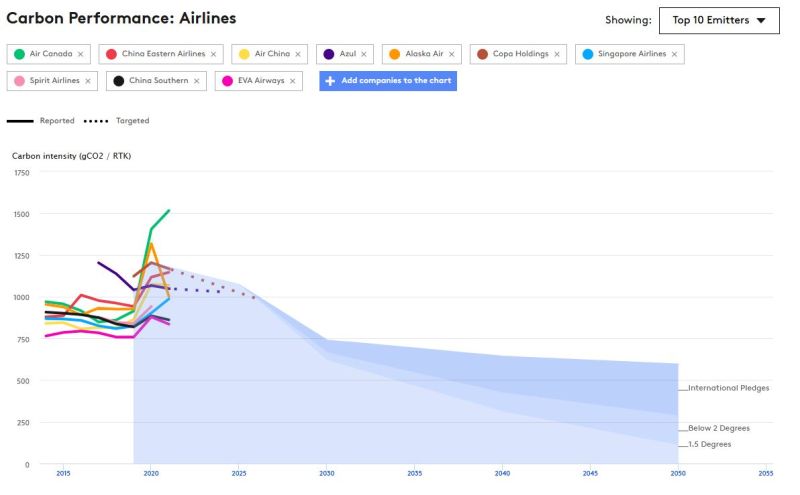

And, in the meantime Air Canada’s emissions continue to rocket higher (chart here from the latest TPI assessment).