In defense of carbon credits

Here’s a note from Nawar Alsaadi:

“If you invest in a forest, the question we ask is, ‘How do you manage wood products versus carbon?’” said Brian Kernohan, chief sustainability officer, private markets, at Manulife Investment Management. The above excerpt from this WSJ article demonstrates the role carbon credits play in introducing a financial dimension to choosing carbon reduction over a commercial decision of felling trees for timber revenues.

Carbon credit have been maligned over the last couple of years, and rightly so, due to the rampant abuse of unscrupulous promotors for carbon credits of dubious quality. Nonetheless, the presence of bad actors shouldn’t invalidate the rationale for having a vibrant carbon credits market. The generation of nature-based carbon credits critical to protecting forests, and other sensitive natural habitats, without these carbon credits co-benefits the commercial case for investing in a large array of natural capital projects is not there. The same applies to biodiversity credits which are at even earlier stage of maturity.

The questions around carbon credits additionality, duration, and leakage can and are being resolved through better carbon markets design, more rigorous regulatory frameworks, and more transparent governance structures. Furthermore, additional innovations such as the emergence of carbon credit insurers of the likes of Oka, The Carbon Insurance Company and Kita will further help maturate and grow this market.

A 2023 paper by EDF, Lombard Odier Asset Management, and Columbia University on carbon markets concluded the following: “The global use of carbon markets could allow the world to nearly double climate ambition relative to current Paris pledges (NDCs) over 2020–2035, without increasing total costs compared to a base case without international markets”

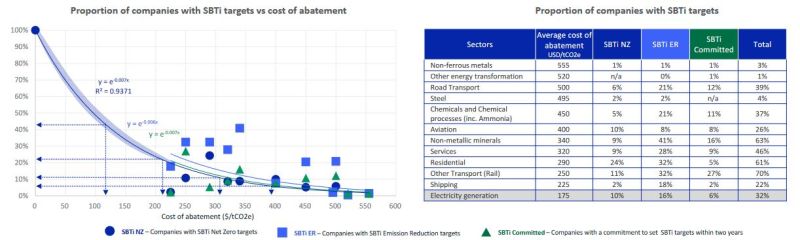

Sectors with high abatement cost are in dire need for a viable carbon credit markets. As we can see from the inverse correlation between average abatement cost and net zero plans (MSCI chart below). MSCI’s research paper on this topic makes the following conclusion: “The use of carbon credits could significantly support the climate ambition and impact of corporates. High-quality carbon credits with strong benefits for the climate, society and nature, are often several times cheaper than the cost of reducing corporate emissions, especially in hard to abate sectors.”

It is always easier to criticize than to build. The battle against climate change and biodiversity loss requires the use of the full arsenal of natural and tech solutions at our disposal. Not to mention, the interconnected nature of climate and biodiversity requires a holistic assessment carbon credits, one that exceeds carbon to one that encapsulates the full spectrum of co-benefits.