How our explosion of data is driving incredible energy demand

Here’s a note from Nawar Alsaadi:

A recent BMO report estimated that 120 zettabytes (ZB = one trillion gigabyte) of data was generated globally in 2023, up from less than 2 ZB only 14 years ago. To put that number into further context, the sum total of all information created by humanity up until 2003 was equivalent to 0.5% of a single ZB.

We’ve actually reached a point where the virtual world is starting to measurably encroach onto the real world. The average hyperscale data center consumes 20-50mW of power per annum (enough energy to power up to 37K homes). Furthermore, the water consumed by such data center equal to 3-5 million gallons of water per day (comparable to the daily water use of a city population around 30/40K people). Today we have a 1000 of those, and it is estimated that 120-130 will be added each year for the next decade. Said another way, we are adding 120-130 small towns (in terms of energy and water usage per year) every year to house and manage our voracious data habits (and this is only in terms of hyperscale data centers).

The above is not news to those following the impacts of AI on energy demand. We’ve all seen the jump in emissions at Microsoft and Google lately. As troubling as these jumps in emissions are, most of the focus has been tied to Scope 2 emissions. This is a problem because we are overlooking Scope 3 emissions, which represent 40% of data center emissions according to Schneider Electric.

Outside of the obvious environmental and climate worries, the above is a major headache for sustainable funds which continue to conflate technology companies with goodness. And where the issue of incorporating Scope 3 emissions in investment portfolios continue to be unresolved.

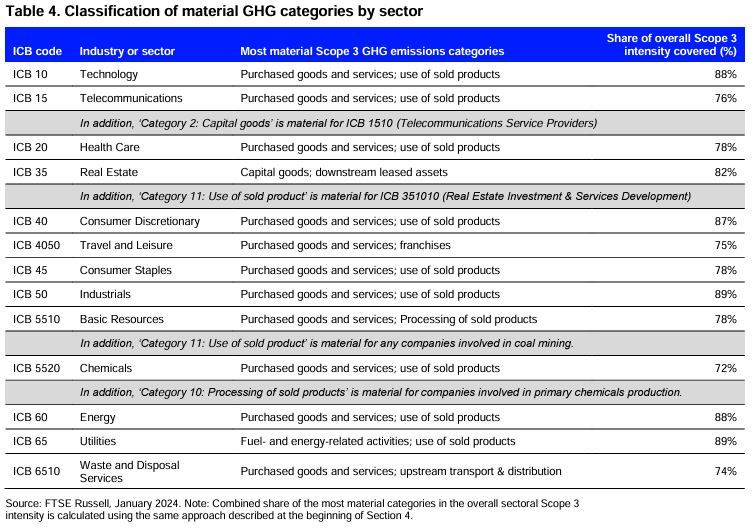

On this last point, I strongly advice those looking for a solutions to the Scope 3 investment problem to read FTSE Russell’s January 2024 paper on the topic. A key finding in the paper is that 2/15 Scope 3 categories in each sector capture on average 81% of that sector Scope 3 emissions. This is a CRITICALLY IMPORTANT finding. Investors can meaningfully simplify their Scope 3 data acquisition (and eventual Scope 3 investment integration) by focusing their data collection and estimation efforts on the two most relevant Scope 3 categories for each sector rather than the full spectrum of Scope 3 emissions categories.

Likewise, corporate engagement with companies on Scope 3 disclosure should focus on the categories most material to their sector. By watering the process down to the most meaningful set of Scope 3 emissions we can go a long way in addressing the question of Scope 3 emissions in corporate disclosure and investor integration.

… But if that fails, we have AI…