Analysis of the ESG software solutions market

Here’s a note from Nawar Alsaddi:

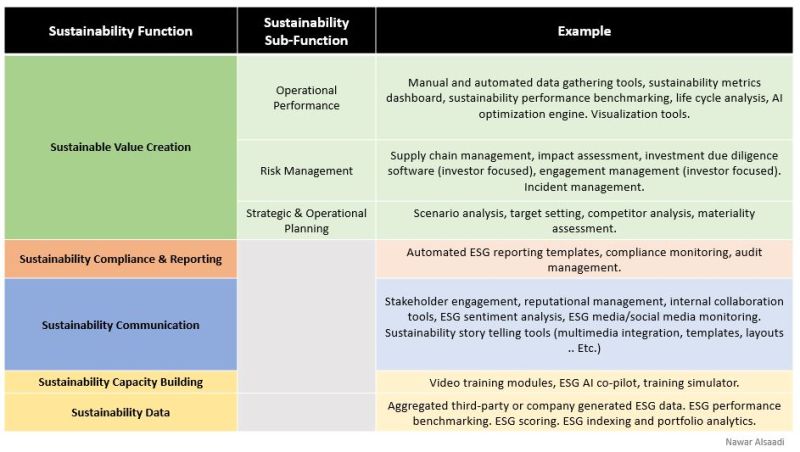

The ESG/Sustainability software solutions market can be broadly divided into five categories:

➡ Sustainable Value Creation (operational performance, risk management, strategic and operational planning)

➡ Sustainability Compliance & Reporting

➡ Sustainability Communication

➡ Sustainability Capacity Building

➡ Sustainability DataIn the attached table, I provide examples of the type of features that would go into each category. It is important to note that some features such as reputational management can fall both under risk management and sustainability communication. Likewise for materiality assessment tools that can fall both under risk management and operational planning.

ESG solutions providers building tools such as the above need to make an informed decision as to why they would choose to play in one – or several – of the aforementioned categories. One of the things to consider is what driving the market for these different categories?

As of now, value creation through operational performance and planning is largely driven by business considerations. Meanwhile, risk management and sustainability compliance/reporting are largely driven by compliance needs. On the other hand, sustainability capacity building is driven by both business and compliance needs.

The market split between corporate users and investors is another consideration. Large scale aggregated sustainability data needs, and ESG indexing solutions are largely driven by investor demand. Meanwhile, sustainable value creation capabilities, compliance/reporting, and sustainability capacity building have varying degrees of demand from both investors and corporates. Other considerations to keep in mind is the split between B2B and B2C, and geographic demand drivers (regulations vs business demand). Understanding the market drivers for your chosen category has material implications on market positioning, pricing, and your growth trajectory.

Outside of demand drivers, it is important to understand how the differing categories interact and support each other. For example, sustainability operational performance tracking tools are a natural fit with ESG compliance and reporting tools. Meanwhile, risk management tools are closely-related to strategic and operational planning tools. As such, when building your product roadmap you need to understand how these pieces fit and enhance each other.

Right now, the market is deeply fragmented between these various solution providers. It is highly conceivable that we will witness the birth of a dominant corporate sustainability operating system (SOS) in the coming years. A solution that captures that totality of these functions, or likely the top 4 categories, in a single platform.